Art for Art's Sake

Towards the end of 2017 global stock markets cheered yet another record year of positive results with the close to 9-year bull market well entrenched in everyone’s psyche. Now in every good bull market there are always signs of excesses and none are more obvious than in the art world.

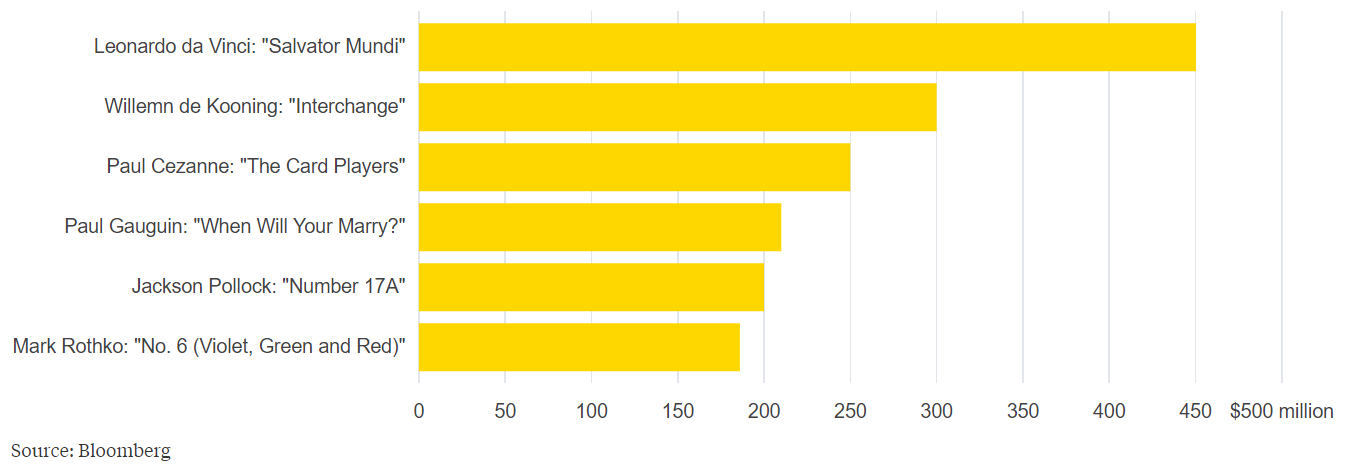

‘Sacrebleu’ is what I’m sure the famous Leonardo da Vinci would be yelling from his tomb in Amboise, France after his work ‘Salvator Mundi’ was sold for close to US$450 million (well in excess of it’s pre-sale estimate of US$100 million).

Now the value attributed to this painting has been brought into question with a dubious history clouding the legitimacy of it. You see it was owned by King Charles I in the 17th century but then it disappeared from records between 1763 – 1900 according to the famous auction house Christie’s which handled the sale process. It resurfaced again in 1858 and then sold in 2005 for less than $10,000. A Russian billionaire by the name of Dmitry Rybolovlev bought it in 2013 for US$127.5 million and was supposedly responsible for selling it to a less than well known Saudi Crown Prince in November.

Largest Art Deals in History

When I see stories like this I start to question markets and asset prices. Is this yet another sign that people are attributing ‘value’ correctly or incorrectly? Has this world of low market volatility, low to zero interest rates, negative European government bond yields and excessive issuance of non-investment grade corporate debt normal?

Another aspect which you might find interesting is that the share price of the other large listed art auction house Sotheby’s; has been somewhat a predictor when it comes to the top of bull market cycles. The aptly named stock code for Sotheby’s is BID and it is listed on the NYSE. As you can see over the last few decades just before major market crashes the share price has topped out. It is fair to say that I will be watching what BID does during 2018!