US Federal Reserve and Interest Rates

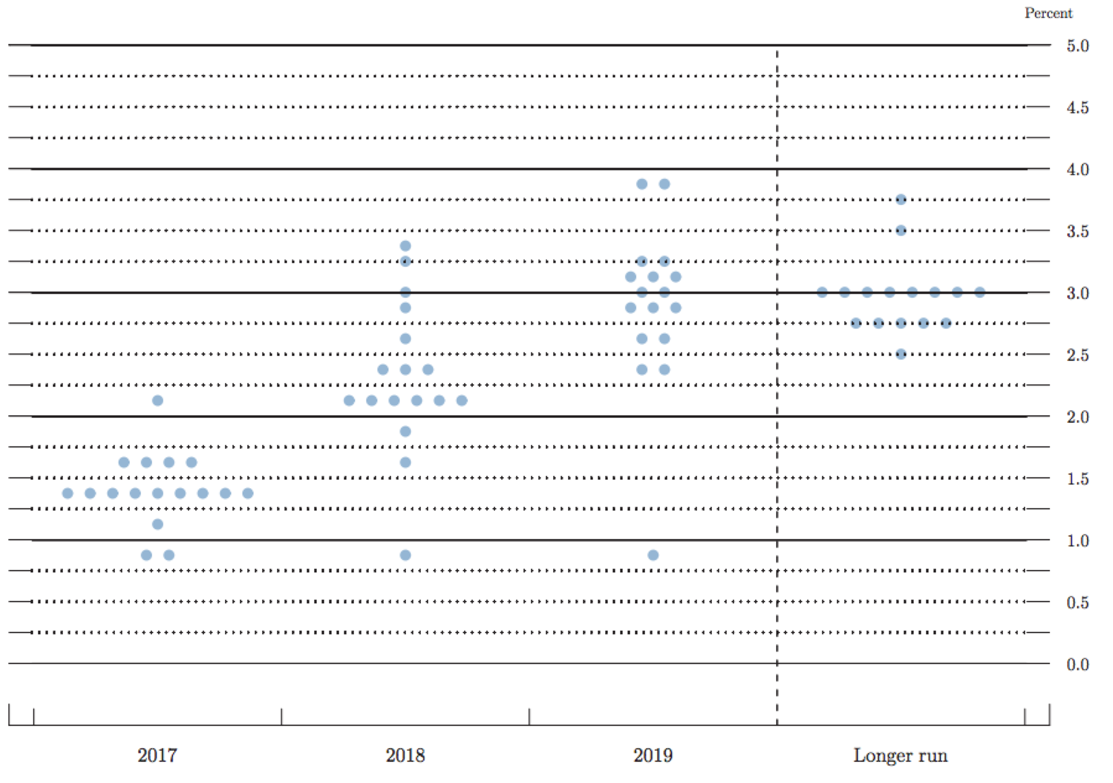

The importance of US interest rates is sometimes misunderstood particularly here in Australia. As the dominant force in financial markets, the direction of US interest rates can cause reverberations across the globe. Decisions made by the US Federal Reserve influence the cost of borrowing, the return on savings and are an important component of the total return of many securities across the world. As part of the documents released each meeting by the US Federal Reserve, a dot plot diagram depicting the direction of interest rate movements has become a lead indicator of future interest rate policy decisions. It shows anonymous projections from members of the Federal Open Market Committee (the rate setting body of the Fed). Each dot represents a member’s view on where the fed funds rate should be at the end of the various calendar years, as well as the long run – the peak for the fed funds rate once the Fed has finished tightening or normalising policy from its current ultra-low levels which were due to the GFC. I have attached the recent dot plot from the March 2017 meeting. It shows that the Fed is aiming for three 0.25 percentage point rises by the end of 2017. This means that at least two other 0.25 percentage based rises in interest rates are on the cards in 2017, one of which will more than likely occur at the upcoming Fed meeting on the 13th -14th June.

For us back in Australia, our banks supplement customer deposits with money raised from overseas investors. If interest rates in the US rise more quickly than anticipated our banks may be forced to hike lending rates to maintain profitability.